-

Smart Liquidity

Maintain effortless access to funds, ensuring smooth operations and timely transactions while keeping your business finances flexible and efficient.

-

Money Movement

Experience seamless inward and outward fund transfers, enabling consistent cash flow and uninterrupted financial management for your growing business needs.

-

Cash Control

Gain complete command over your business finances with secure, quick, and organized transaction management tailored for smarter cash handling.

-

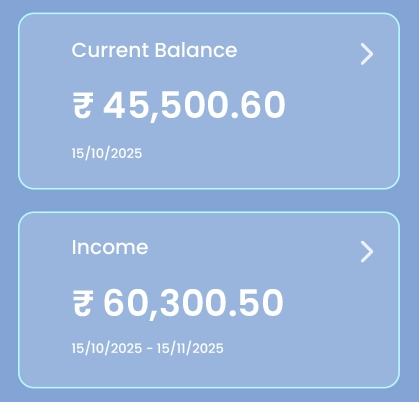

Fund Flow

Ensure continuous financial stability by managing income and expenses efficiently, promoting steady cash circulation and optimized business operations.

-

Finance Stream

Streamline every financial process through efficient fund allocation, instant payments, and optimized liquidity for sustained business performance and growth.